What Does Payment Checkup Do?

Table of ContentsExcitement About Online Payment SystemsSome Known Details About Card Processing The Main Principles Of Merchant Account Little Known Facts About Payment Processing.The Best Guide To Online Payment SystemsIndicators on Merchant Account You Should KnowThe Main Principles Of Payment Solutions

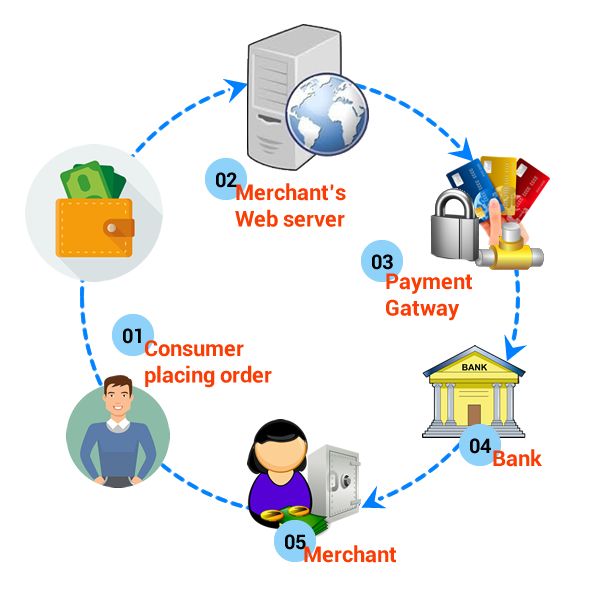

Transaction standing is returned to the settlement gateway, then passed to the website. A consumer receives a message with the deal condition (approved or refuted) via a settlement system interface.

Now we are moving closer to settlement gateways in their range. To integrate a settlement system into your site, you will need to follow several actions. Payment portal integration Normally, there are 4 primary approaches to incorporate a settlement gateway. Every one of them differ by 2 major elements: whether you need to be in conformity with any kind of economic policy (PCI DSS), and also the degree of customer experience concerning the checkout and settlement procedure.

Some Ideas on Payment Processor You Should Know

What is PCI DSS conformity and also when do you need it? In instance you simply need a settlement entrance remedy and also do not plan to store or process charge card data, you might miss this section, due to the fact that all the processing and also governing burden will certainly be carried out by your entrance or repayment company.

This safety standard was created in 2004 by the four most significant card associations: Visa, Master, Card, American Express, and also Discover. There are 4 degrees of compliance that are figured out by the number of safe deals your company has actually completed.

SAQ is a collection of requirements and also sub-requirements. The current version has 12 requirements. AOC is a type of exam you take after reviewing the demands. There are 9 types of AOC for various services. The one required for retailers is called AOC SAQ D Merchants. The listing of ASVs can be found here.

The Main Principles Of Online Payment Systems

Provided this details, we're going to take a look at the existing integration options and explain the pros and cons of each. We'll additionally concentrate on whether you need to abide by PCI DSS in each case as we clarify what combination methods fit various sorts of organizations. Hosted entrance A hosted payment portal serves as a 3rd party.

Generally, that's the situation when a consumer is rerouted to a payment gateway website to key in their bank card number. When the transaction data is sent, the customer is redirected back to the merchant's web page. Here they finalize the check out where deal approval is revealed. Hosted repayment entrance work scheme of a held payment gateway are that all payment handling is taken by the solution company.

Using an organized entrance requires no PCI conformity as well as supplies rather simple integration. are that there is a lack of control over a held gateway. Customers may not rely on third-party payment systems. Besides that, redirecting them away from your website lowers conversion price and doesn't aid your branding either.

The Only Guide for Payment Processor

Pay, Chum Check Out suggests integration in the type of a Smart Payment Button. Generally, it's an item of HTML code that applies a Pay, Buddy button on your checkout web page. It conjures up the Pay, Buddy Remainder API phone call to validate, collect, and also send repayment info through an entrance, whenever a customer causes the button.

Direct Blog post technique Straight Article is an integration method that allows a consumer to shop without leaving your web site, as you do not have to obtain PCI compliance. Direct Article thinks that the transaction's information will certainly be uploaded to the repayment portal after a customer clicks a "purchase" switch. The information immediately reaches the gateway and processor without being saved by yourself web server - Merchant Account.

The Main Principles Of Payment Processor

Below are some things to consider prior to deciding on a carrier. Research study the rates Repayment handling is complicated, as it includes a number of monetary organizations or organizations. Like any kind of service, a payment portal needs a fee for making use of third-party tools to process as well as authorize the purchase. Every celebration that takes part in payment verification/authorization or processing costs costs.

Every repayment remedy service provider has its very own terms of use and also charges. Usually, you will have the complying with cost types: entrance configuration cost, monthly entrance fee, vendor account arrangement, and also a cost for each deal refined.

Merchant Account Can Be Fun For Anyone

This is primarily a prebuilt gateway that can be customized and also branded as your own. Here are some well-known white label services made for sellers: An incorporated portal can be a dedicated source of profits, as vendors that get all the necessary compliance become payment provider themselves. This implies your business can refine settlements for various other sellers for a charge.

You can customize your settlement system as you desire, as well as tailor it to your company requirements. In situation of a white-label remedy, the settlement gateway is your branded innovation.

Research the prices Payment processing is intricate, as it consists of numerous financial organizations or organizations. Like any type of service, a settlement gateway requires a charge for using third-party tools to process and also authorize the deal.

Get This Report on Ecommerce

Every settlement service service provider has its very own terms of use as well as charges. Generally, you will have the following cost kinds: entrance setup charge, month-to-month gateway cost, merchant account configuration, and a cost for every deal refined. card processing Check out all the prices paperwork to avoid hidden charges or extra costs. Inspect transaction restrictions for a provided company While charges as well as installation fees are inescapable, there is one point that may establish whether you can collaborate with a specific carrier.